As I said last week in Risky Business: part 1, we will now compare two fictional businesses in the same industry. Whilst these two businesses have the same turnover and profit, they have vastly different risk profiles.

The businesses we will compare are two butcher shops. To understand the potential risks for both, we will, for the purpose of this exercise, assume they both have the following financial results:

- Total income of $2.6 million

- Net profit before owner’s salary and super of 9% is $250,000

*By the way, these numbers have been taken directly from FMRC benchmarks.

If you just focussed on the financial reports of these two businesses, you would most likely believe they were worth the same amount.

Let’s delve a little deeper

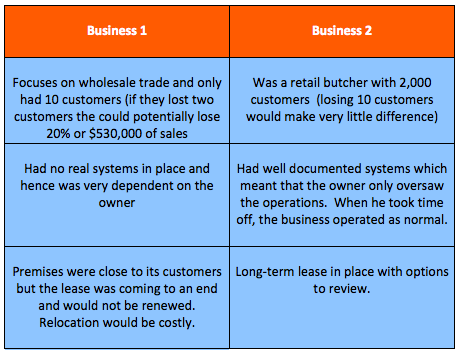

What if you then found out the following information about the two businesses

It’s quiz time:

Knowing these facts puts a completely different light on these two businesses.

Which business do you think will be worth more based on these facts?

- Business 1, or

- Business 2?

I will be posting the results and the answers soon, so make sure you sign to my blog or follow us on Facebook to access this information.